Best-Selling Male Enhancement Products for Smoke Shops and C-Stores in 2025

Best-selling male enhancement products for smoke shops and c-stores in 2025 tend to share a few traits: strong branding, discreet but bold packaging, impulse-friendly price points, and fast, noticeable effects according to customer perception and repeat sales patterns in this niche. For your blog, you can focus less on specific brand names and more on the product types, features, and merchandising tactics that consistently move volume in these retail environments.

What “best‑selling” really means in this niche

In smoke shops and c-stores, “best-selling” does not always mean the most expensive or the most clinically sophisticated formula. It usually means the product that turns quickly, has low returns or complaints, and gets requested by name or description from regular customers.

Many retailers track this informally at first by watching which SKUs need reordering most often and which ones sit on shelves. Over time, store owners who treat this as a real category build simple systems (POS tags, weekly inventory checks, and staff feedback) to identify their consistent top sellers.

Core categories of top sellers

Among male enhancement items sold through smoke shops and similar stores, several product formats tend to dominate: single-dose “shots” or pills, small multi-count packs, and increasingly, gummies. These formats share a few advantages: they are easy to display, easy to explain quickly at the counter, and easy for customers to try without a big financial commitment.

Gummies and soft chews are gaining traction because they feel less like “medicine” and more like a lifestyle or wellness treat, which matches trends in other categories like CBD edibles and nootropic snacks. Meanwhile, classic capsules and tablets still remain strong for customers who associate pills with potency and familiarity.

Key features winning in 2025

Across brands, the best-selling male enhancement products in 2025 tend to highlight a few consistent benefit claims: stamina, firmness, recovery time, and overall confidence. On the ingredient side, many popular formulas emphasize botanical blends such as ginseng, maca, horny goat weed, and similar herbs that customers already recognize from online reviews and word of mouth.

Retail buyers also pay close attention to how clearly the packaging communicates timing: how soon customers might feel effects and how long a single dose is meant to last. Bold, simple promises like “fast-acting” or “all-night” resonate more in a busy c-store than dense scientific language that is hard to explain in a 10-second conversation at checkout.

Packaging and branding that drive sales

In a crowded enhancement display, packaging is often the difference between a product that moves and one that collects dust. Top performers usually have high-contrast colors, bold brand names, and iconography that suggests strength, energy, or virility without being so explicit that it embarrasses the buyer.

Small footprint packaging also matters because these products frequently sit near the register, where space is limited and expensive. Peg-ready blister packs, gravity-feed counter displays, and small point-of-purchase boxes allow retailers to keep top sellers visible and fully stocked, which directly influences how often customers add them as impulse purchases.

Price points and margins that work

For smoke shops and c-stores, the sweet spot for many enhancement products is a retail price low enough to feel like an impulse buy but high enough to support both wholesaler and retailer margins. Single-dose packs often sit in a band where a regular customer can grab one or two on a payday visit without much hesitation.

Retailers often keep a range: a “budget” option for price-sensitive buyers, a mid-range product with strong branding that becomes the everyday top seller, and a premium SKU for customers who want “the strongest one you have.” This ladder lets the store upsell without turning away customers who are just testing the category for the first time.

Customer profiles and buying behavior

In this category, repeat buyers are incredibly important: a product that brings customers back every week or every month becomes a foundational SKU. Many of these customers shop late evenings or weekends, and they often already buy related items like energy drinks, CBD, kratom, or other wellness products.

Staff feedback is particularly valuable, because customers may ask confidential questions or share results directly with clerks they trust. When multiple team members report that “everyone keeps asking for that one in the red pack,” that is a clear signal to stock deeper and give that item more prominent placement.

Compliance and quality considerations

For retailers, the best-selling product is only truly “best” if it is safe, legal to sell in their jurisdiction, and backed by a reputable supplier. That means verifying that enhancement products come from known wholesalers, checking that packaging includes supplement facts, usage instructions, and appropriate warnings, and avoiding items that imitate prescription medications too closely.

Many wholesalers and retailers now emphasize third-party testing, clear labeling, and tamper-evident packaging as selling points, which can reassure both store owners and customers. Including small table tents or shelf talkers that mention quality control or lab testing can also help justify a slightly higher price for well-made products.

Merchandising strategies to turn best-sellers faster

Even the strongest enhancement product can underperform if it is hidden or poorly merchandised. Smoke shops and c-stores that win in this category usually do a few things consistently: place their top-selling packs at eye level near the register, keep displays full and tidy, and group related male and female enhancement items together for easier browsing.

Rotating a small number of new test SKUs into the same display lets retailers spot emerging winners without overwhelming the customer with too many choices. Simple signage such as “Customer Favorites” or “Most Requested” above the highest-turning products can nudge undecided buyers toward the SKUs that already sell the best, reinforcing momentum

How retailers can choose their own best-sellers

For a smoke shop or c-store just building this category, the smartest move is to treat initial orders as experiments: pick a balanced mix of formats (pills, gummies, shots), price tiers, and branding styles. After a few weeks, compare sales data, shrinkage, and customer feedback, then double down on the top performers and drop the slow movers

Over time, the store’s “best sellers” list will become specific to its own customer base, even if it overlaps heavily with broader market trends. That is the point where the retailer can negotiate better pricing on high-volume SKUs, invest in custom displays, and position itself as the local shop “that always has the good ones in stock,” which is the real competitive advantage in this space.

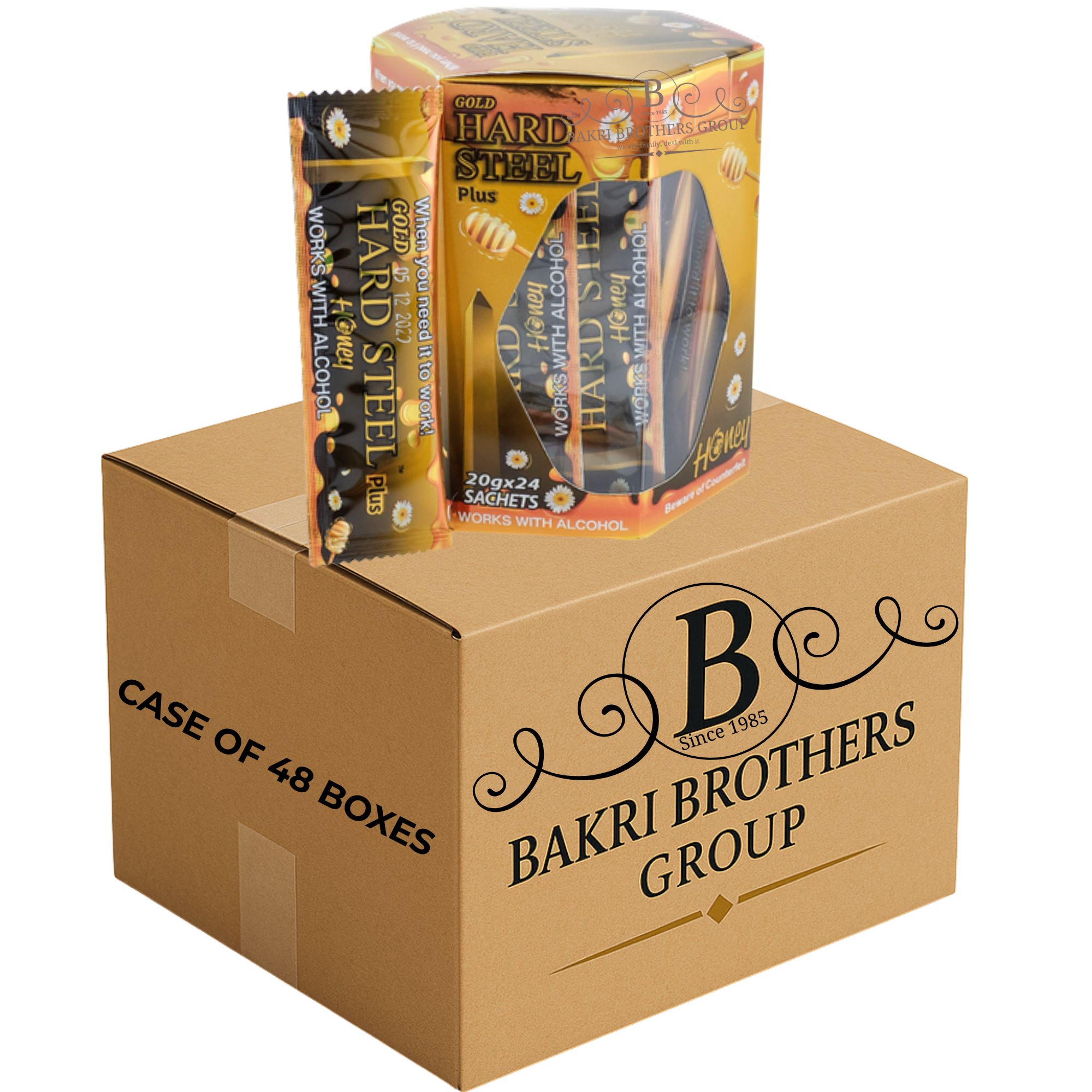

Honey

Honey Pills

Pills Liquid Shots

Liquid Shots Gummies

Gummies Chocolate

Chocolate Candy

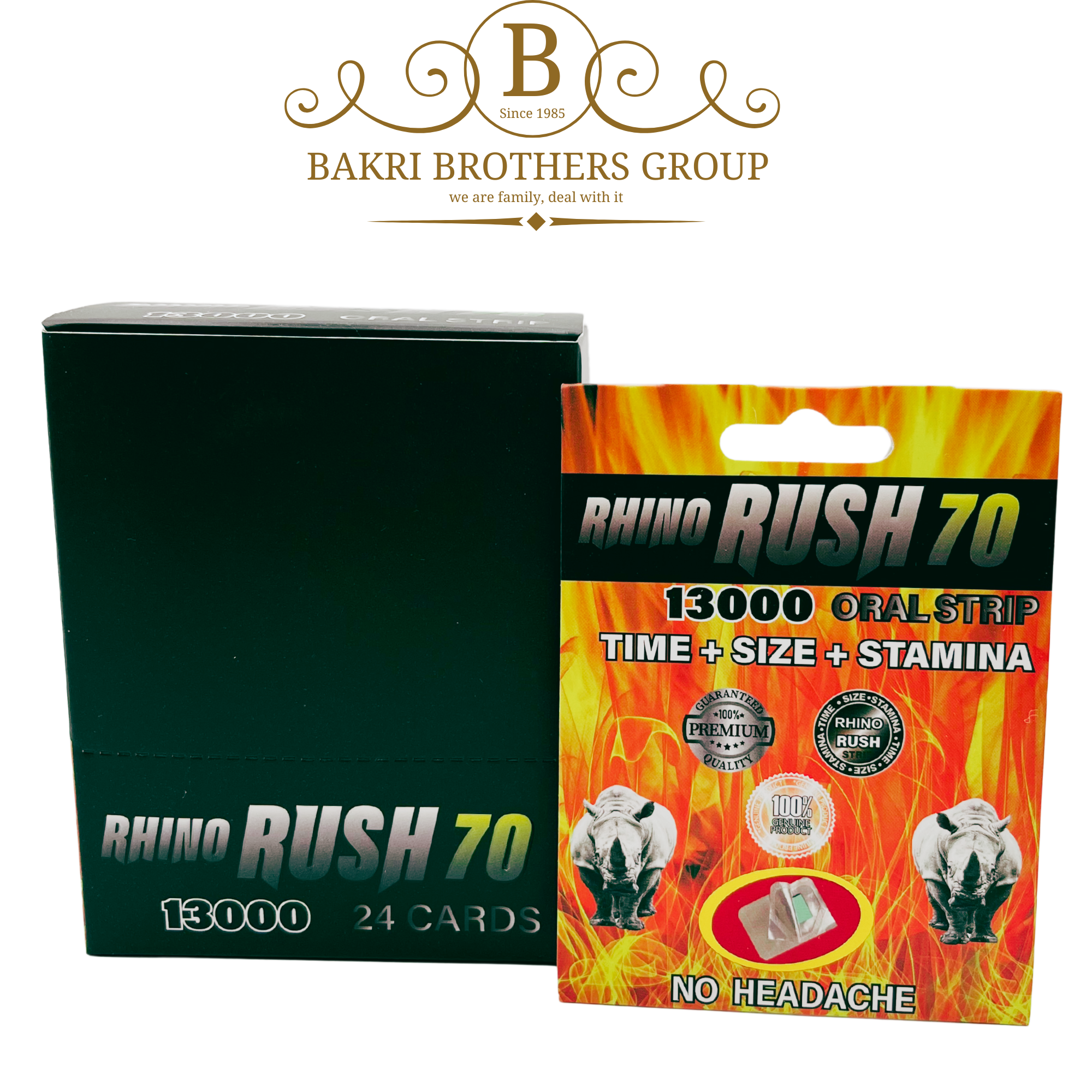

Candy Strips

Strips